Introduction

Background

Loan eligibility is primarily dependent on the income and repayment

capacity of the individual(s). There are other factors that determine the

eligibility of loan such as age, financial position, credit history, credit

score, and other financial duty.

Problem Description

Loan Approval Prediction is automate loan eligibility

process from customer details. These details are Gender, Marital status,

Education, Number of dependents, Self-employed, Monthly income, Loan Application

amount and Credit history. In this process identify the customer segmentation

and those are eligible for the loan amount.

Interest

Financial Company or banks needs to automate the loan eligibility

process based on customer detail provided while filling online application

form. In this project used to automate

loan eligibility process from historical data for customer details.

Data acquisition and cleaning

Data set

Range Index:

614 entries (0 to 613)

Data columns: 13 columns

Data type

Dataset have three type of data types of the values. These

are Object, Float and Integer. The number of categorical datatype in shown in

figure 1.1.

Data cleaning

1. First downloaded the data from source and find the data

information, description and shape of the data in after analysis. There were missing

values from dataset, because of lack of record keeping. And also lot of data is

object type. It is trouble to feature prediction. So we change the datatype

from object to numeric values.

2. Data set has to several problems, so start the cleaning of data.

3. Many columns are contain object type of datatype. And then some other columns are complicated values like date, float and negative values. After drop the unwanted columns based on further analysis.

4. After fixing these problems, I checked for outliers in the data. I found there were some extreme outliers, mostly caused by some types of small sample size problem.

Feature Selection

Final step of the Data acquisition, Feature selection is important to the predictive

modelling. After data cleaning, there were 194673 samples and 49 features in the data. Upon examining the

meaning of each feature, it was clear that there was some redundancy in the

features. But these data set contain all features are important to future

predicting.

Exploratory Data Analysis

The

problem is Loan Approval prediction. So the target value is Loan Status. The Loan

_Status column contain loan approved or not. It is categorical (Yes / No)

values in shown figure 1.2.

Figure 1.2

Gender

is common feature of identical data. It is the

range of characteristics pertaining to, and differentiating between,

masculinity and femininity. It has two different types of feature in this

columns. There are male and female. The total number of male is 489 and total

number of female is 112. And then given plot is define how many male or female

approval for loan in shown figure 1.3.

Figure 1.3

Marital status is

one of the important features. It distinct options that describe a person’

relationship with a significant other. Here are some of the important ways a

change in marital status can affect the target variable. The value of ‘Married’

are ‘Yes’ and ‘No’. The total number of ‘Yes’ is 398 and total number of ‘No’

is 213. And then given plot is define marital status for loan approval in shown

figure 1.4.

Education is major role on loan approval prediction. Loan

eligibility criteria is pursing graduate or post graduate degree. It has to contain two values, there are

‘Graduate’ and ‘Not Graduate’. The total number of ‘Graduate’

is 480 and total

number of ‘Not Graduate’ is 134. And then given

plot is define Education for loan approval in shown figure 1.5.

Figure 1.5

Self-Employment is another major role on loan approval prediction. Here

the maximum applicants are not self-employed for this dataset. The value of ‘Self-Employed’

are ‘Yes’ and ‘No’. The total number of ‘Yes’ is 82 and total number of ‘No’ is

500. And then given plot is define Self-Employed for loan approval in shown

figure 1.6.

Figure 1.6

The distribution is represent for

log transformation. The log transformation can be used to make highly skewed

distributions less skewed. This can be valuable both for making patterns in the

data more interpretable and for helping to meet the assumptions of inferential

statistics.

The plots are different between normal distribution and log

normal distribution for total income in shown figure 1.7.

Figure 1.7

This plot are different

between normal distribution and log normal distribution for loan amount in

shown figure 1.8.

Figure 1.8

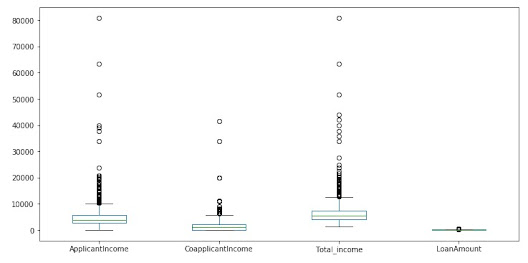

Box plot of major features

The box plot is represent shape of distribution, its central value, and

its variability. Its helps to understanding of data in shown figure 1.9.

Figure 1.9

Correlation between each

data

Correlation of data is define relationship between each

columns in the data. It has to understand how to handle the data and columns.

In this plot of diagram is represent with different colors of range (-0.2 to

1.0). The range of color is negative value, it low rate of correlation between

the data. For example, Education and Loan Amount is low correlation of each data.

Its correlation value is -0.2.

The range of color is

equal to zero, it normal of correlation between the data. In dataset more

amount of columns are correlation between each data should be normal. For

example, Gender and Self_Employed, ApplicantIncome and Loan_Amount_Term.

Figure 1.10

The range of color is positive value, it high rate of

correlation between the data. Each columns are highly correlated in x-axis and

y-axis. So both are same values. And otherwise some columns are highly correlated.

For example, Total income and Application Income is high correlation of each data.

Its correlation value is 1.0. The correlation of each data is visualize in

shown figure 1.10.

Relationship between

major features

The matrix plot is represent to the relationship between major features.

In this plot visualize the data based on scatter plot and histogram. The

histogram is present in diagonal. The scatter plot is represent to the

relationship between major columns without diagonal. The matrix plot in shown

figure 1.11.

Figure 1.11

Predictive Modelling

Predictive modelling uses statistics to predict outcomes. It is the general concept of building a model that capable of making predictions. Typically, such a model includes a machine learning algorithm that learns certain properties from a training data set in order to make those predictions.

Models

Models can use one or more classifiers in trying to determine the probability of a set of data belonging to another set. There are two types of models, Regression and Classification.

Regression is Supervised Learning task where output is having continuous value. The goal here is to predict a value as much closer to actual output value as our model can and then evaluation is done by calculating error value. The smaller the error the greater the accuracy of our regression model.

Classification is a Supervised Learning task where output is having defined labels (discrete value). The goal here is to predict discrete values belonging to a particular class and evaluate on the basis of accuracy. It can be either binary or multi class classification. In binary classification, model predicts either 0 or 1; yes or no but in case of multi class classification, model predicts more than one class.

In this project target value is categorical type (discrete value). So I choose classification model.

Applying standard Classification algorithms

Classification in machine learning and statistics is a supervised learning approach in which the computer program learns from the data given to it and make new observations or classifications. A classification model attempts to draw some conclusion from observed values. Given one or more inputs a classification model will try to predict the value of one or more outcomes. Outcomes are labels that can be applied to a data set.

There are a number of classification models. Classification models include K nearest neighbor and Naive Bayes, Logistic regression, Decision tree, and Random forest.

Performance of Models

Model evaluation metrics are required to quantify model performance. I choose the model evaluation metrics depends on our machine learning task such as classification algorithms. In precision – recall are useful for multiple tasks.

I applied some classification matrix for model evaluation. There are Classification accuracy and Confusion matrix. Classification accuracy is the number of correct prediction made as a ratio of all predictions made. Confusion matrix provide a more detailed breakdown of correct and incorrect classification for each class. And also fine Actual and predicted values (True and False).

It estimated performance of a model tells as how well it preform on unseen data. And also I find best classifier on this problem based on the table, it is decision tree. It has to high accuracy and better result on confusion matrix. In table explain performance of different models.

Conclusion

Finally, I predicted the loan approval based on further analysis.

I achieved above 80% accuracy in classification algorithms. That is helps to

identify the eligibility of loan. And also analysis of major features, it used

to get better result of this problem.

Purpose of this project was to predict the Loan Approval. Company wants to

automate the loan eligibility process based on customer details. These

details are Gender, Marital status, Education, Number of dependents,

Self-employed, Monthly income, Loan Application amount and Credit history. In

this process identify the customer segmentation and those are eligible for the

loan amount.

And you want to explore the project:

No comments:

Post a Comment